Free Legal Fee Estimate in Minutes from Attorney Sequeira by Email, Phone or Chatbox

You searched for hours trying to find the “right” attorney. You poured through reviews and made multiple calls. You even paid hundreds or thousands in consultation fees, hoping that you would be given options, but in the end, you were told nothing could be done.

You have come to the right place! For the first time ever, you can be quoted a legal fee estimate without a consultation!

How do I do this? Because when you call, you will speak to me. And since I am an attorney, I am capable of accurately assessing your case.

There are two ways to take advantage of this revolutionary approach! Either send me a detailed email (the more case facts the better), and after I read it, I will either respond via email, or, if I have questions, I will call you for a brief chat.

Not a good writer or prefer to talk on the phone? Alternatively, you can give me a call (leave a voicemail if I do not answer) and within the first few minutes, I will ask very specific and targeted questions. Based on the answers that you provide, I will ask a few more questions. Within about 10 minutes, I will have gotten all of the information that I need to quote you a legal fee estimate. For this to work efficiently, your responses need to be brief and “to the point”.

Doubtful? Call me today and see for yourself.

Why aren’t other attorneys doing this? I presume it has to do with the law firm’s policies or procedures (e.g. completing an intake), calendaring the consultation, etc. But since I am the owner, I get to create my own polices and procedures.

Other attorneys are not specialized in only immigration; they handle criminal, family, and bankruptcy, or other fields. Still others, just don’t know what questions to ask, process the answers, and ask follow up questions because they don’t know the field well enough. But I do because I have spent the last 15 years handling only complex immigration cases. In doing so, asking the right questions is like second nature to me.

The caveat to this is that you must fully disclose all relevant facts, so if you don’t know them, you need to find them out. In addition, I usually request that certain documents be sent to me so I can confirm that what I am being told is accurate.

So you have absolutely nothing to lose!

Believe it or not, I developed this approach because even though I spent my time, I “felt bad” taking a consultation fee only to tell my client that there was no immigration relief available at that time. This doesn’t happen too often because I am creative and can usually suggest something. In fact, many times I have been told “the other attorney didn’t tell me what you are telling me.”

There is too much at stake to risk your American dream on an attorney who treats you like a number.

Don’t wait. Call me today at (301) 529-1912.

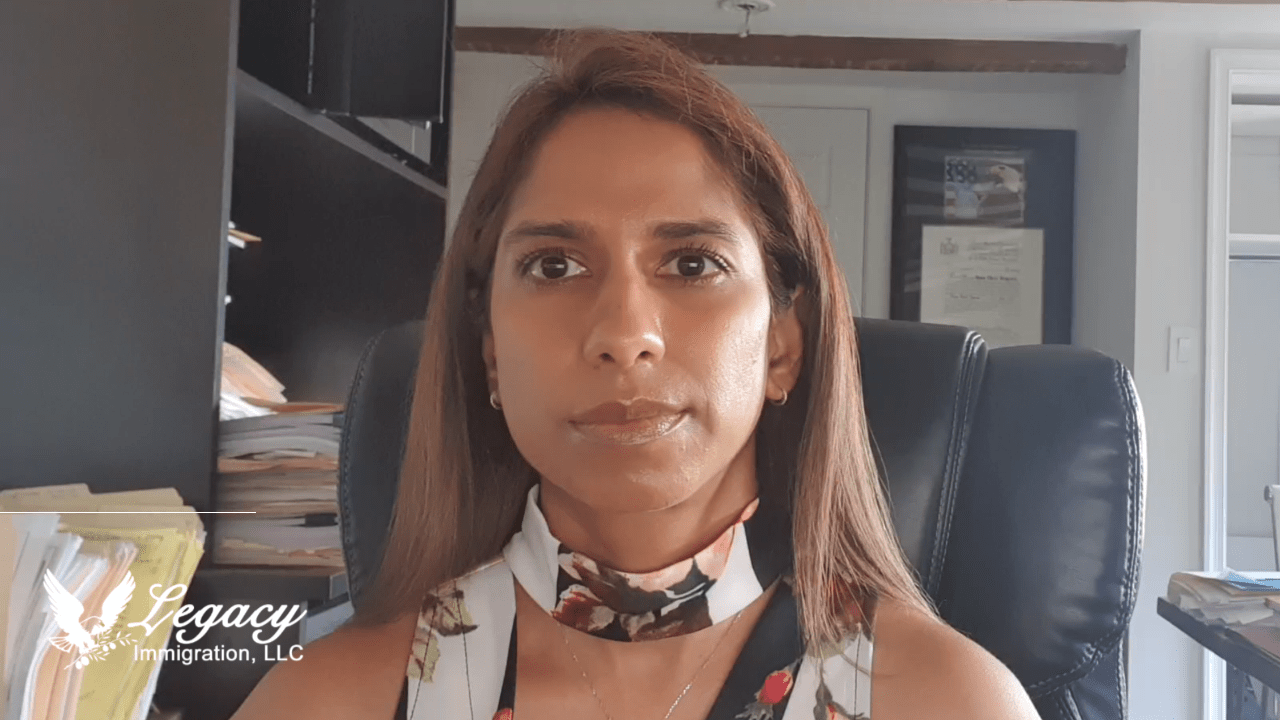

Hear More From Dawn ...

Video Playlist

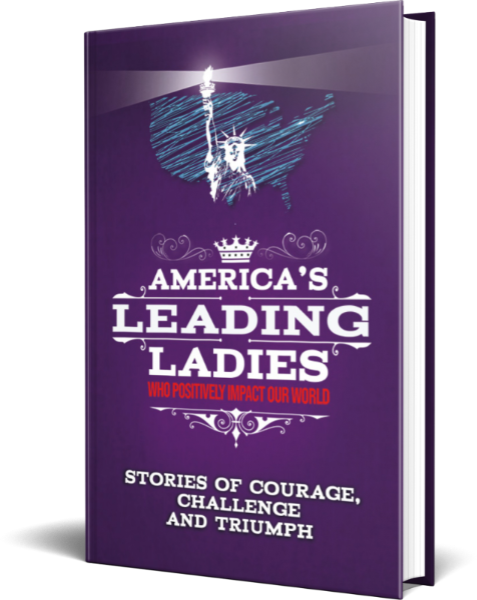

Dawn C. Sequeira, Esq. Featured in America's Leading Ladies - Who Positively Impact Our World

In this book, Dawn C. Sequeira, Esq, Oprah Winfrey, Melinda Gates, and 50 women of distinction share their success stories, and in their inspiring optimism and passion to moving forward, speak to all of us – to take charge of our own destiny and live our dreams!

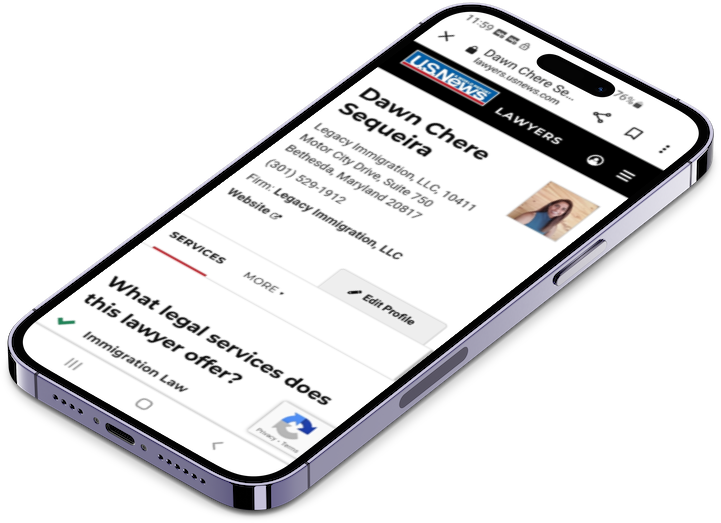

Find Legacy Immigration's Dawn C. Sequeira at U.S. News & World Report!

The U.S. News Lawyer Directory – powered by Best Lawyers® features top attorneys throughout the United States.

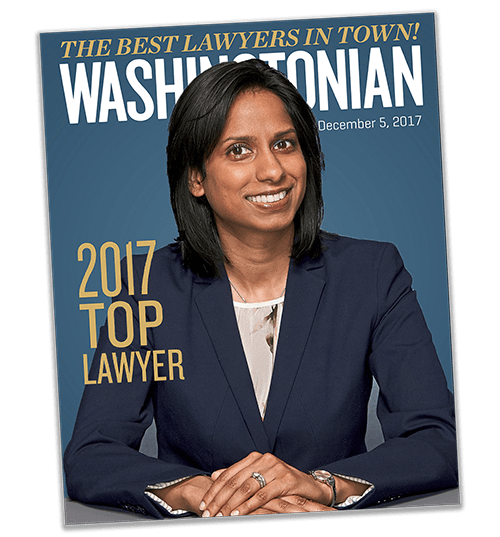

Legacy Immigration Named Among Top Lawyers In Washington, D.C. 2017 to 2022

Legacy Immigration’s Dawn C. Sequeira was named among “Washington’s Top Lawyers” by Washingtonian Magazine 2017 to 2021 (current issue) acknowledging the top 1% of attorneys in the D.C. metro area. Dawn C. Sequeira was chosen as one of the top immigration attorneys.

Legacy Immigration Invited To The TLC Show 90 Day Fiancé

Attorney Dawn Sequeira has been contacted twice to be on TLC’s popular show 90 Day Finance. 90 Day Fiancé is a reality television series that follows couples who have applied for and going through the K-1 visa process. The K-1 visa allows the fiancé from a foreign country to travel to the United States to live with his or her prospective spouse.

I’m TOO Passionate!

In a relationship, who would you say cares more? A partner who takes no interest in where you go and what you do, or, someone who fights with you because you don’t spend enough time with him/her? The latter, right?

I took an oath to “Advocate Vigorously” for you. I am passionate because I care so much, sometimes as much, or even more than my client. Why am I so passionate or why do I care so much? On the astrological chart, I am a Sagittarius, which I am told, is a “fire” sign. I am very passionate about winning my client’s case, especially the super tough ones. Believe me, I wish that I could “turn off” the passion button, but it’s deeply engrained in me, so I have come to embrace it as part of my personality.

But I have been told that that is what my clients love about me and can notice it from the very first call.